We're committed to helping you grow and protect your business. Manage your business' finances on your terms with the latest online and mobile banking technology. Full-featured banking online and on-the-go.Multiple ways to waive service fees and unlimited digital transactions helps you keep more of your money. It's a built-in feature with your Business Complete Checking account. Process all major debit and credit cards with QuickAccept. Convenient access to payment processing.

#CHASE CHECKBOOK COVERS FULL#

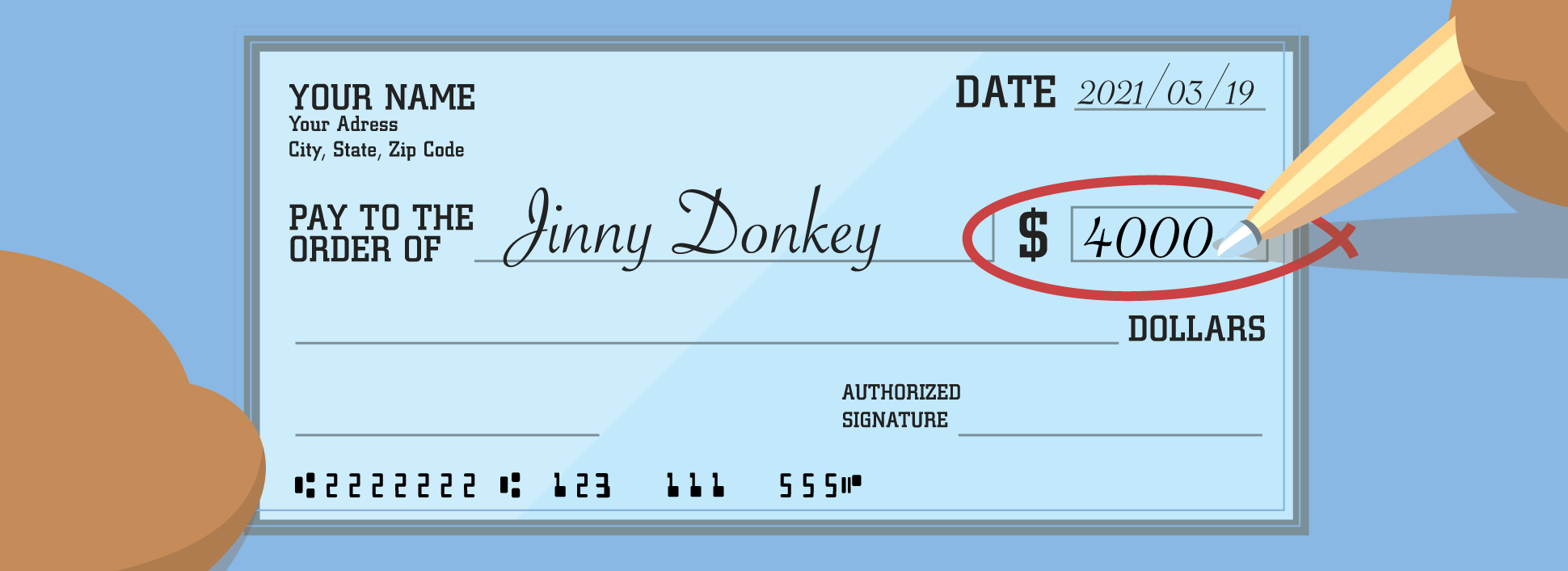

Choose from a full range of options for accepting payments and making deposits that include Zelle ®, Online Bill Pay, wire transfers and ACH payments. Convenient access to all your business banking services in one place - lending, checking, credit card and payment solutions. Multiple ways to waive the Monthly Service Fee, including maintaining a minimum daily balance or purchases on your Chase Ink ® Business credit card.For new Chase business checking customers with qualifying activities. Earn up to $500 when you open a new Chase Business Complete Checking℠ account.Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. *With Chase Overdraft Assist℠, we won't charge an Overdraft Fee if you're overdrawn by $50 or less at the end of the business day OR if you're overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist℠ - no overdraft fee if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*.Available online nationwide except in Alaska, Hawaii and Puerto Rico.Chase Mobile ® app - Manage your accounts, deposit checks, transfer money and more - all from your device.Access to more than 16,000 Chase ATMs and more than 4,700 branches.New Chase checking customers enjoy a $200 bonus when you open a Chase Total Checking ® account and set up direct deposit.To sign up for a Chase checking account online, you'll need your:

And you can start an account on their website in just a few minutes. Checkbook registers Chase Checking Account OptionsĬhase checking accounts offer a variety of features to suit just about any need.In addition to your checks, you can order items such as: Add a message or byline above the signature.Alter the font or lettering for your personal info.Choose a background symbol as a shadow in the background of the check.Add a symbol or monogram in the upper left corner.

#CHASE CHECKBOOK COVERS UPDATE#

If you need to update your address, you'll need to head to Profile & Settings on Chase's online banking platform.Ĭhase offers select enhancements to your checks. Changing your address on checks won't affect the address on your Chase account.

0 kommentar(er)

0 kommentar(er)